|

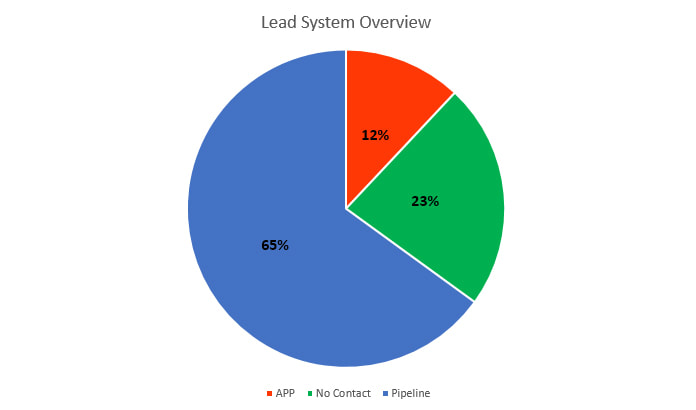

After speaking with thousands of Mortgage Professionals nationwide, I have found that the majority of Loan Officers get their business from 3 different channels. They are either relying on Realtors, buying shared leads, or utilizing platforms such as Google and/or Yelp. These avenues are great for generating business but they usually have one thing in common - they are somewhat inconsistent. If you're looking to scale your business, the bottom line is that you need a system in place. Something that is truly consistent in delivering results month after month without having to depend on the methods mentioned above. Something that can help you determine the cost associated with acquiring new clientele. Once something of that nature is in place it becomes relatively easy to scale your Mortgage business to whatever extent you desire. It all boils down to simple math, let me explain... For those of you who don't know me, I like to describe myself as an Online Marketing Strategist who specializes in helping Mortgage Professionals across the United States achieve their goals and take it to the next level. For this example I will use the last 3 months of data to help deliver the main point of this article. Over the last 3 months I have helped deliver exactly 225,369 exclusive, live, long-form Home Buyer, Refi, & VA referrals to Loan Officers across the nation. I have created the Pie Chart below for visual reference. As you can see in the diagram above, statistically 12% (near 15% with follow-up automation and/or CRM integration) of all leads go to application within the first 30-45 days of generation, 65% go into the Loan Officer's Pipeline (credit, buying time-frame, etc.), and 23% result in no progression (failed contact attempts, bad number, etc.).

Now, based off this system and the statistics provided... it's relatively easy to scale your business. For the sake of example, let's say your goal is to close 10 deals a month or you want to make $30,000 (average deal being $3000 in commissions)... then you approximately need 168 leads. This will result in 20 App's signed ( with a rate of 50% converting to financing). Every market is different but once the CPL (cost per lead) is determined, you will know how much money to allocate to ad-spend. From there, the sky is the limit! To summarize, it's essential to have a reliable system in place that helps determine your cost per client acquisition. That is... if you're looking to take your Mortgage Business to the next level. What type of system do you have in place?

1 Comment

|

AuthorKris Pattison. Archives

August 2017

Categories |

Location |

|

RSS Feed

RSS Feed